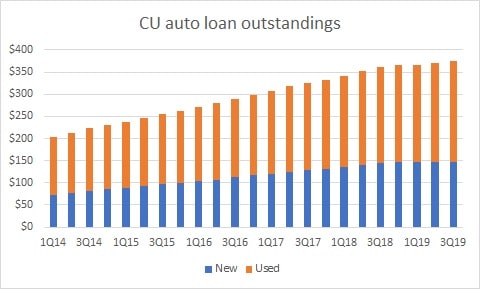

Credit unions closed out the third quarter with a combined $374.2 billion of new- and used-auto loan outstandings, up 3.5% year over year, according to fresh data from the National Credit Union Administration.

New-car loans totaled $147.3 billion — up 2.1% year over year — while used-car loans totaled $226.9 billion — up 4.4%.

The ratio of new-car loans versus used has been hovering in the high-39% range since late 2016. Last quarter, though, new-car loans accounted for 39.4% of total outstandings, the lowest level in the past two years. Industry wide, lenders have been increasingly originating used-car loans as consumers seek lower monthly payments.

Meanwhile, auto loan delinquency rates fell 2 basis points to 0.58%, the lowest rate recorded for a third quarter since the NCUA started to break out the information in 2014.

Here’s a look at credit union auto loan outsandings (in billions) since 2014, based on NCUA data:

For more content like this, join us at the upcoming Auto Finance Accelerate event, March 9-11 at the Omni San Diego. Combining three crucial topics in auto lending and leasing, Auto Finance Accelerate dives into the strategies and knowledge needed to enhance your company’s auto finance sales, marketing, and innovation. Register before Friday, January 31st to save with early registration rates. Visit www.AutoFinanceAccelerate.com to learn more.

Like This Post"auto" - Google News

December 10, 2019 at 12:57AM

https://ift.tt/2PrVnhW

CU auto outstandings top $374B in 3Q | Auto Finance News - Auto Finance News

"auto" - Google News

https://ift.tt/2Xb9Q5a

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "CU auto outstandings top $374B in 3Q | Auto Finance News - Auto Finance News"

Post a Comment